The facts

With the adjustment of the Energy-climate lawif you are owner lessorIf you want to continue renting your property, you may need to carry out work on it.

If you are owner-occupierIf you want to sell your property, carrying out renovation work will reduce your energy bills and increase its value over time.

As a result, those who have flats with a poor rating will no longer be able to rent them out (level G) or will see their rents frozen (level F). The government is therefore forcing them to carry out work to bring their properties up to standard in order to obtain an F rating. more acceptable energy rating.

The direct consequences that result from these new standards are :

- The difficulty of selling your property if the DPE shows a poor energy classification

- Not being able to rent out your property

- Rent freeze

- The loss of value of the property on the market, compared with new developments or low-energy housing.

The only alternative is to carry out work.

As we all know, banks won't lend above 35% of debt, which can put a brake on your renovation projects.

There are several ways of doing this:

- Borrowing the amount needed

- Pay from your own funds

- Group your loans if you have several outstanding loans

- Do buy your mortgage

The Board

Whether you own your main residence or investor with multiple assetsThe benefits of carrying out work on your home or homes will be far-reaching:

- Improve the value of your property and its energy performance in both cases

- Anticipate a future law that would toughen up the rules already in place

In the case of a bank loan :

- Take advantage of rates interest rates are still relatively low: it is still more attractive to borrow than to use savings, which can be invested at a higher rate.

- Keeping savings safety equipment to deal with any unforeseen event

- Activate a tax mechanism that is the deficit land (if you have rental flats and under certain conditions). This will enable you to increase the yield on rented properties.

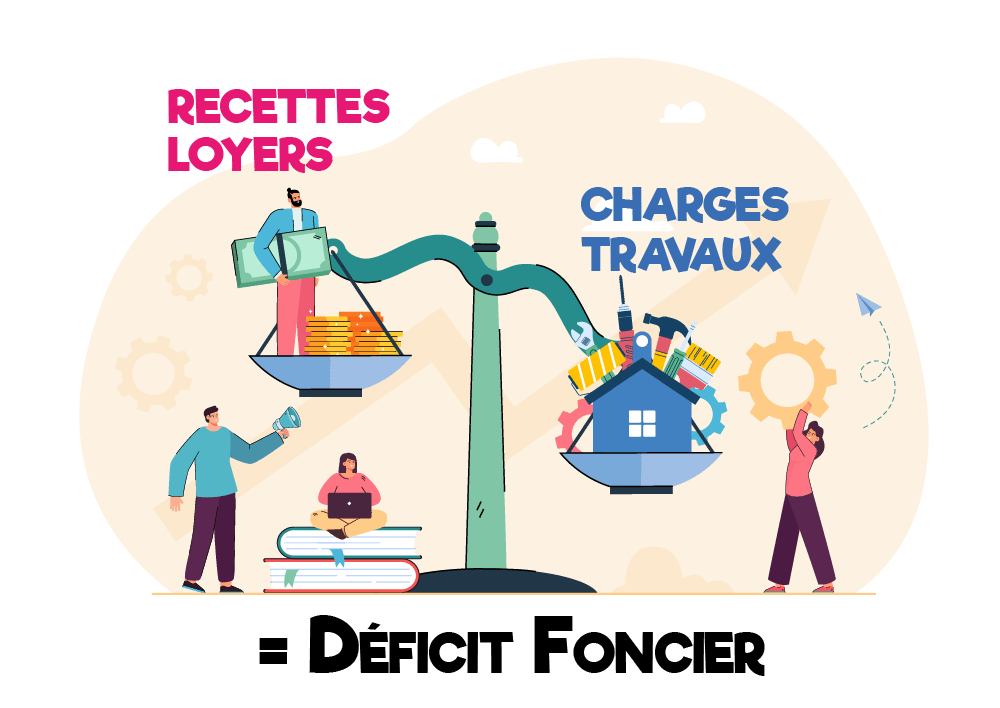

Land deficit

When you invest in rental property, you can benefit from a tax break if your expenses exceed your income. This mechanism, known as the property deficit, allows you to reduce the amount of tax you pay when you carry out certain works.

The revenue mainly correspond to income from property.

The expenses that can be deducted from your property income are, for example :

- the administration and management costs for your property

- the cost of various works carried out

- or the interest on your loans.

Attention : There are a number of conditions governing access to this tax advantage (whether or not the work is deductible, maximum limits for the work and for the tax reduction, whether the property should continue to be rented out, incompatibility with the micro-foncier scheme, etc.).

Contact us for more information or for a calculation of this land deficit.

There are other options, which may not have the same appeal as the one mentioned above, but which will enable you to carry out your work.

Other possible solutions

Credit consolidation

It can be considered if you have several outstanding loans (property, car, etc.) and consists of restructuring your debts by buying them all (or part of them) over a single term and at a single rate.

- This can help to release a works budgetthanks to lower monthly payment generated by the operation

- This can imply an increase the overall cost of your credit

Buying a home loan

It is an opportunity that should be seriously considered to free up borrowing capacity or give a breath of fresh air to a tight budget, provided that the purchase is still profitable.

This involves buying back your current loan at the current (lower) rate, thereby lowering your monthly payment and enabling you to take out a new works loan without increasing your debt ratio.

- The total cost of your loan will remain unchanged, depending on how much you save by buying it back

- This can imply an increase the overall cost of your credit

ECO PTZ

It is used to finance energy-efficiency renovation work on a home. It is an interest-free loan of up to €50,000. It is not means-tested, but you must have been the owner or landlord of a property for more than two years.

- The unbeatable rate: 0%

- Tedious procedures and sometimes long lead times

Whatever your project, your situation, your doubts or your certainties, contact us !