A drop in income or activity, or a complex personal event, can make it difficult for you, the borrower, to repay your current loans.

In these exceptional circumstances, it is sometimes possible to suspend or defer repayment of the monthly instalments on your loan.

What steps do I need to take?

- Check your loan offer, not all banks allow you to defer part, all or all of your monthly payments. This must be written into your contract.

If this is the case, then we recommend that you check the conditions once or several times a year, age of the loan contract, etc. - Get in touch with your banker to check the terms and conditions and, above all, the costs involved. impact on the total cost of your loan if the repayment period is extended.

What are the possible solutions?

Temporary suspension (or deferment) of your credit

It allows you to suspend payment of your loan instalments for a certain period of time and involves amendment giving you details of the deferment, together with an new depreciation table indicating the adjusted loan amount and term.

Deferment is not possible with all types of loan.

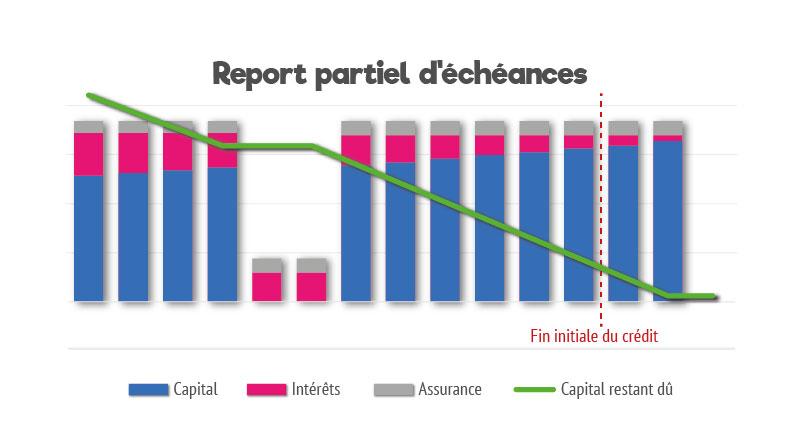

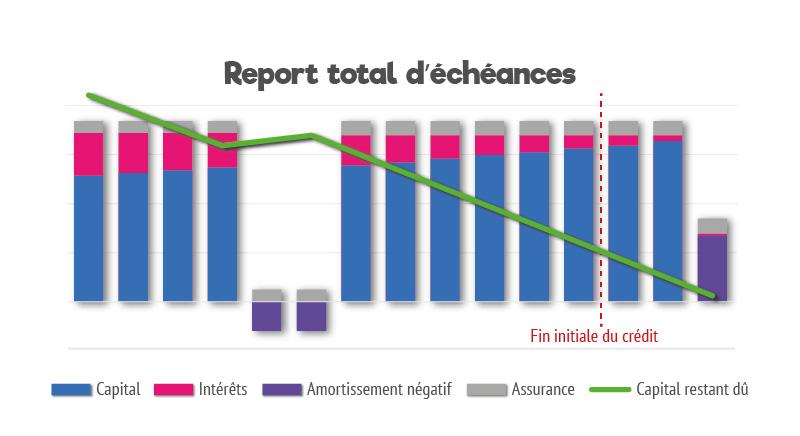

A distinction must be made between :

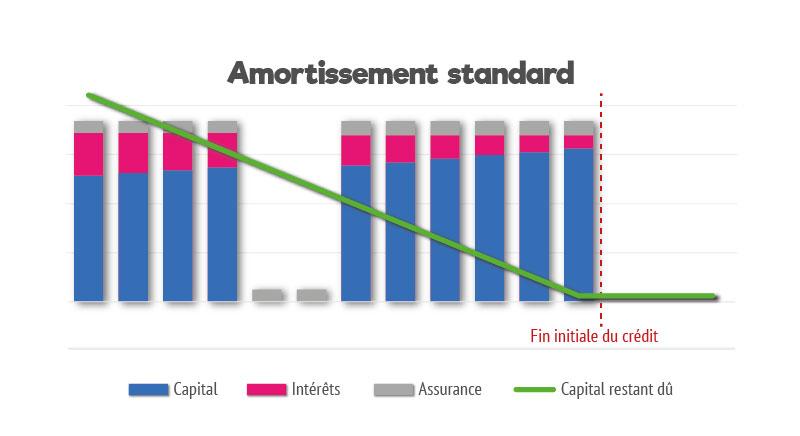

To get a clearer idea of the impact of these two solutions, we invite you to compare them with the standard amortisation of the same mortgage:

In both cases, the deferred monthly instalments are to be paid at the end of the loan, which can extend the initial term of the loan or increase maturities after deferral.

This suspension can range from one to twelve monthsin one or more times.

It can therefore have a high costThis is because the repayment period is extended and therefore generates additional interest.

Modulating loan repayments

It allows you to to lower (or increase if your finances allow) the loan term initially determined.

Modulation is only possible after at least one year's amortisation.

Banks offer the following options one modulation per yearwith a reduction in monthly payment from 10% to 30% (depending on the bank) and a maximum loan extension from 12 to 24 months.

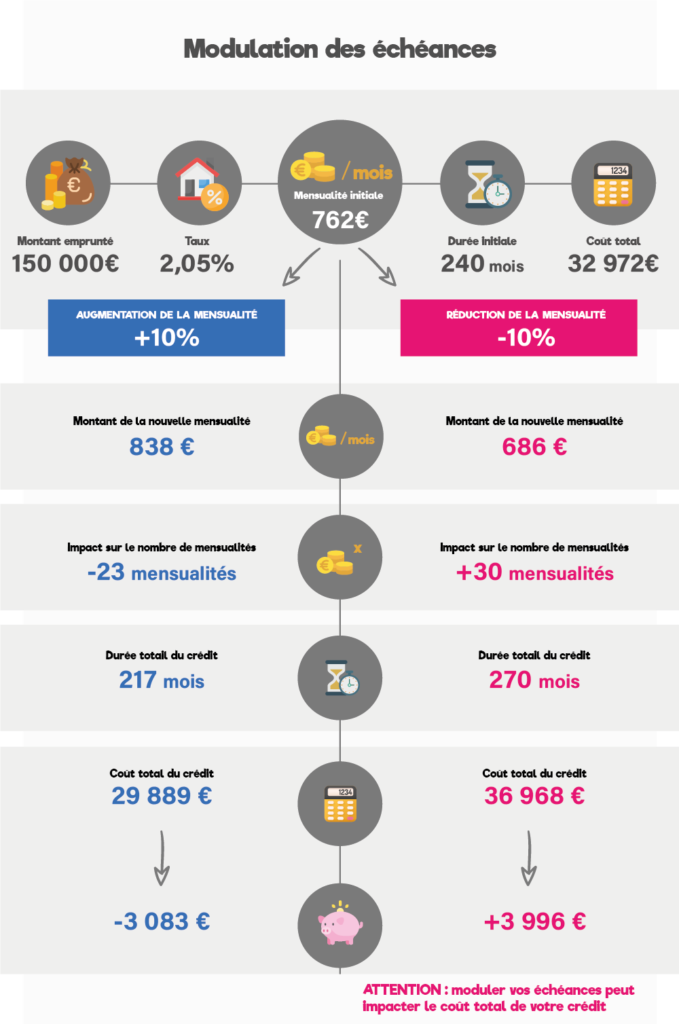

Below is the example of a couple who have borrowed €150,000 over 20 years at a rate of 2.05 % and let's look at the impact of an upward or downward adjustment (10 %).

The total cost of the loan may also increase, but less significantly than when the repayments are deferred, because you continue to pay part of the monthly instalments.

Even if these arrangements have a cost, they are still interesting temporary solutions to financial difficulties.

Don't hesitate to contact us so that we can work together to find the best solution for you.