Contents

About usAccourtage

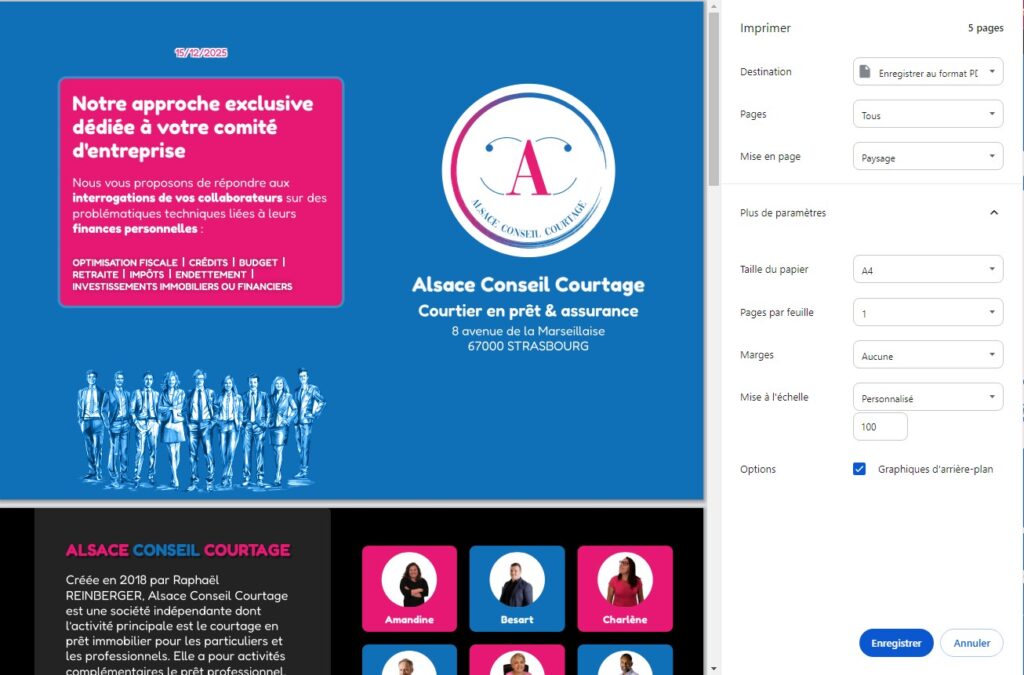

Created in 2018 by Raphaël REINBERGER, Alsace Conseil Courtage is an independent company whose main activity is property loan brokerage for individuals and professionals throughout the Grand-Est region.

Its complementary activities include business loans, asset management and loan insurance. Today, we have agreements with almost all the banking players in the region.

Our firm of mortgage brokerage and loan insurance

ALSACE CONSEIL COURTAGE SAS, a broker in banking and payment services (COBSP) and an insurance or reinsurance broker (COA), is registered with ORIAS under number 18008247.

Real estate credit brokerage, a specific credit intermediation service, consists of "presenting, offering or assisting in the conclusion of banking transactions or payment services or carrying out any preparatory work or advice in connection therewith".

Our team consists of a twenty or so independent consultants (MIOBSP and MIA) and 2 employees at your service to help you turn your plans into reality.

Our vision,

Our values

Our aim is to make brokerage accessible to everyone, whether through client meetings or our communications policy.

Our aim is to provide a quality service, both in terms of the conditions and the choice of contact person.

We take care to ensure a win-win relationship between all partners, both in terms of commitments and compensation.

Our services

Composed of experienced agents complementary areas of expertise, we support our customers in their efforts to search for financing it is real estate, professional or in the debt consolidation.

Composed of asset management agentswe provide our customers with solutions for both thetax optimisation than in the building up financial and property assets.

Our activities in detail

Envelope calculation to optimise borrowing capacity of our customers to thecomplete support in their process (from the compromise to the signing of the deed), we are there to help at every stage of their project.

Investment tax exemption investment heritageWe offer our customers made-to-measure assemblies to adapt to their constraints and optimise their profits.

From the decrease in maturity to the reduction in the loan periodWe provide our customers with the best possible advice to enable them tooptimise their earnings according to their needs.

The fall inoverall maturity to enable our customers to breathe to theoptimising outstandings in order to reinvestWe do everything we can to find solutions to their needs.

From creation financing from a structure to investment in premises or equipment, we support professionals in the development of their business. key stages in their development.

Advice on choice of insurer at follow-up in the event of a claimWe support our customers in all aspects of their business and provide them with a comprehensive range of services. informed advice tailored to their personal situation.

Your customer path with ACCOURTAGE

1

Find out about your project and put together your file

2

Consulting banks and negotiating your terms

3

Presentation of proposals and selection of the best solution

4

Appointment at the bank and acceptance of terms and conditions

5

Checking the loan offer for signature

End

Welcome your home

Our support project

1

Appointment 1 : Preparing the application

2

Appointment 2 Presentation of agreements

3

Organisation of meeting bank

4

Present for the entire bank meeting

5

Review of the loan offer

Why entrust us your projects

Sponsorship offer

Refer a friend and receive up to €300 for every completed application

Tell everyone about it!